Market Intelligence in Public Tendering

For a Bid Manager or a Commercial Director, few situations generate as much frustration as receiving the "contract awarded to another bidder" notification after weeks of work. But the worst part isn't losing; the worst part is not knowing why you lost or discovering, months later, that your competitor won with a margin you could have easily improved upon.

Public procurement has stopped being a volume game and has become a precision game. Continuing to tender based on intuition or outdated spreadsheets is, today, an unacceptable financial risk.

In this article, we analyze what market intelligence means in tendering, what data you need to make profitable decisions, and how to implement a Go/No-Go analysis strategy.

Why You Lose Tenders (And the Real Cost of Not Using Data)

Many companies operate with a blindfold on. They invest huge resources in preparing the administrative documentation (Envelope A) and the technical proposal (Envelope B/C), but they define their financial offer based on feelings or internal theoretical margins, ignoring market reality.

This "blind bidding" approach creates three black holes in your profitability:

- Opportunity Cost: Spending hours on tenders where, historically, the contracting authority has an incumbent provider with strong technical or service entry barriers.

- Margin Erosion: Winning contracts while leaving money on the table because you offered an unnecessarily low price.

- Low Success Rates: Systematically losing by not adjusting the offer to the sector average or the abnormally low tender threshold (reckless bidding) for that specific type of file.

The Data: According to sector studies, companies that apply market intelligence in their triage phase increase their success rate by between 15% and 25% in the first year.

As sector experts point out, many companies fail to secure awards after investing time and money, not due to a lack of technical solvency, but due to a lack of tools and clarity regarding pricing strategy and competition.

The 3 Key Market Intelligence Data Points in Public Procurement

To move from a reactive stance to a proactive strategy, your team needs to answer three critical questions before mobilizing resources. This is what we call the viability or Go/No-Go analysis:

1. Competitor Analysis: Who Is Really Winning?

Knowing who your rivals are in the general market is basic; market intelligence goes further: you need to know who wins in that specific administration.

- Is there a supplier who takes 80% of the contracts from that City Council?

- Do they bid as a Joint Venture (UTE)?

- Is it a tender with genuine competition or a recurring formality?

Detecting these patterns allows you to decide if the effort is worth it or if it is better to look for opportunities in bodies where the competition is more fragmented.

2. The Average Drop: The Secret to Competitive Pricing

The Base Bidding Budget (PBL) is just a theoretical ceiling. The critical data point is the actual award price. Knowing the historical average drop (discount) of your competitors in similar files (CPV and geographical zone) allows you to fine-tune your financial offer.

The goal is to position yourself in the "sweet spot": low enough to gain points in the economic formula, but high enough to protect your margin and avoid the presumption of abnormality (abnormally low tender).

3. Behavior of the Contracting Authority

Not all public entities buy the same way. Although the Law on Public Sector Contracts (LCSP) seeks the best price-quality ratio, in practice, the weighting varies enormously.

- Does this body aggressively prioritize price?

- Do they usually award high scores in subjective value judgments?

- Are they agile in paying, or do they have a high average payment period?

Analyzing the award history allows you to predict these trends and adapt your technical and financial proposal to what that contracting committee actually values.

How to Obtain This Data: The End of Manual Searching

The main problem with performing this analysis is the dispersion of information. Trying to cross-reference this data manually by visiting the Public Sector Contracting Platform and dozens of regional profiles is unfeasible. Reading hundreds of procurement documents (pliegos) and award reports in PDF to extract a price data point would cost you more money in staff hours than the profit of the contract itself.

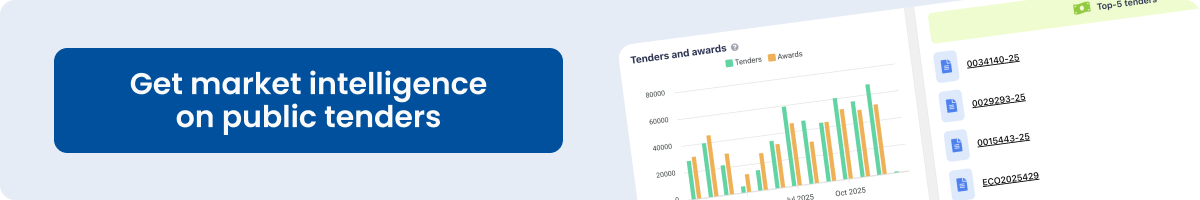

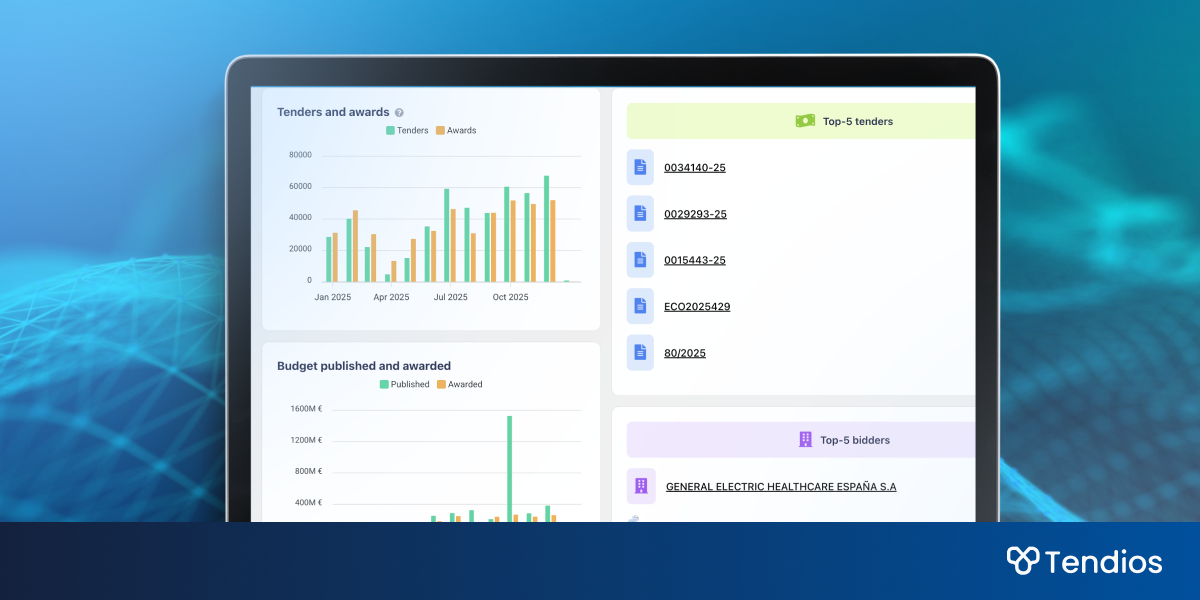

This is where GovTech technology makes the difference. Artificial Intelligence platforms like Tendios not only aggregate millions of tenders from all sources in Spain and Europe in real-time, but they also structure that data to offer you:

- Competitor Monitoring: A dashboard to see who wins, at what price, and with what discount/drop.

- Predictive Document Analysis: An AI that reads the documents for you and extracts the solvency and award criteria in seconds.

- Rigor and Veracity: Unlike generic tools, our specialized AI does not "hallucinate"; it bases its analyses on verifiable data from real files and current regulations.

Conclusion: Profitability Through Data

The difference between a company that survives in the public sector and one that scales its business is the quality of its information. Stopping bidding blindly means stopping treating public procurement like a lottery and starting to treat it like data science.

Want to see what data the market has on your competitors?